Hours

Mondays & Thursdays

9:00am - 12:00pm

You may call to schedule an appointment outside of the regular office hours

FAQs

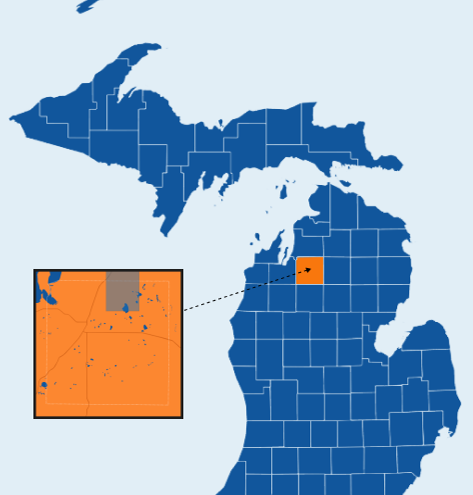

- Cash, check or money order —Pay in person at the Township offices during regular business hours (Mondays and Thursdays 9:00 AM to 12:00 PM), or send by mail to the Township, or leave in our secure drop box located by the front door of the Township office. Please make checks payable to Coldsprings Township and mail to P.O. Box 380, Mancelona, MI 49659.

- Credit Card or Debit Card—Pay with your VISA, MasterCard, Discover Card or American Express Card using one of these methods. A 2.95% convenience fee will be added.

- You can pay with your credit card in person during the Treasurer’s regular office hours.

- You can pay with your credit card via telephone by calling the Township Treasurer’s office during the Treasurer’s regular office hours

- You can pay online through this AllPaid link. In the search field please enter Coldsprings Township.

Important Reminders About Paying Your Taxes

Please provide a contact telephone number with your check or bill so that we know the best way to contact you with any issues. There is a $25 fee for returned checks. Please make checks payable to Coldsprings Township, and mail to P.O. Box 380, Mancelona, MI 49659.

If you are mailing your payment, please note that we do not accept postmarks. Payments must be received by September 16th, 2024 to avoid interest. Interest begins on September 17th at 1%, with an additional 1% for each month thereafter until paid. Beginning March 1st, 2025, any unpaid taxes will be turned over to the County Treasurer for collection. Additional fees and interest may be added. Deferment applications are available upon request. The County Treasurer can be reached at (231) 258-3310.

Due to the continued rise of postage costs, receipts will no longer be automatically provided with payment but will be provided upon request.

From the Kalkaska County Register of Deeds sign up for a Free Property Fraud Alert. Sign up today for free alerts to notify of you of ANY documents recorded with your name match in Kalkaska’s land records. If a document is recorded, you will be contacted by phone, text or email (your choice) within 48 hours. Your contact information is not shared with any entities, it is used strictly for notification purposes. Sign up by going to www.propertyfraudalert.com. For more information, please contact JoAnn DeGraaf, Kalkaska County Register of Deeds at 231-258-3315.

Responsibilities

The duties can vary slightly from one township to another, but there are common responsibilities that most Township Treasurers have. These duties often include:

- Tax Collection: The Treasurer is responsible for collecting property taxes, including summer and winter taxes, and any special assessments.

- Funds Management: The Treasurer manages all township funds, including depositing collected monies in designated depositories and ensuring proper accounting of these funds.

- Financial Reporting: The Treasurer prepares and presents regular financial reports to the township board.

- Investment Management: The Treasurer is responsible for the investment of township funds, ensuring that investments comply with state laws and township policies.

- Disbursement of Funds: The Treasurer oversees the disbursement of township funds, ensuring that all expenditures are authorized and properly documented.

- Record Keeping: The Treasurer maintains accurate records of all financial transactions, including receipts, disbursements, and bank reconciliations.

- Budgeting: The Treasurer works with the Supervisor and other township officials to prepare the annual budget, providing input on revenue projections and expenditure requirements.

- Delinquent Taxes: The Treasurer manages the process for collecting delinquent taxes, including sending notices, applying penalties, and working with the county treasurer on foreclosure proceedings if necessary.

- Audit Coordination: The Treasurer coordinates the annual audit of township finances, working with external auditors to ensure compliance with state laws and accounting standards.

- Public Interaction: The Treasurer interacts with township residents, answering questions related to tax bills, payments, and other financial matters.

For a comprehensive and specific list of duties, you can refer to the Michigan Township Association or your local township's office, as they often provide detailed job descriptions and responsibilities. The Michigan Compiled Laws (MCL) also provides statutory duties of township officials, including the Township Supervisor.