What are the eligibility requirements for receiving the Homeowner’s Principal Residence Exemption?

You may claim the homeowner’s principal residence exemption if you meet all of the criteria below:

A. You are a resident of the State of Michigan.

B. You own and occupy the home as your principal residence.

C. Neither you, nor your spouse if you file a joint income tax return, receive an exemption, deduction, or credit substantially similar to the Michigan Homeowner’s Principal Residence Exemption on property you own in another state.

D. You have not filed a non-resident Michigan income tax return.

E. You have not filed a tax return as a resident of another state.

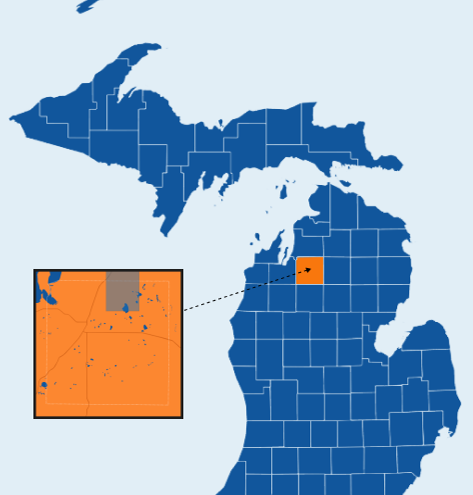

The filing deadline for receiving the Principal Residence Exemption in Coldsprings Township is June 1st.